The 7-Minute Rule for Estate Planning Attorney

Wiki Article

Estate Planning Attorney Can Be Fun For Anyone

Table of ContentsSome Known Details About Estate Planning Attorney What Does Estate Planning Attorney Mean?Estate Planning Attorney - The FactsThe Of Estate Planning AttorneyThe Only Guide to Estate Planning AttorneyThe Best Strategy To Use For Estate Planning AttorneyThe Best Strategy To Use For Estate Planning Attorney

That you can avoid Massachusetts probate and sanctuary your estate from estate taxes whenever possible. At Center for Senior Citizen Law & Estate Planning, we recognize that it can be tough to believe and talk regarding what will occur after you pass away.We can help (Estate Planning Attorney). Call and establish up a totally free assessment.

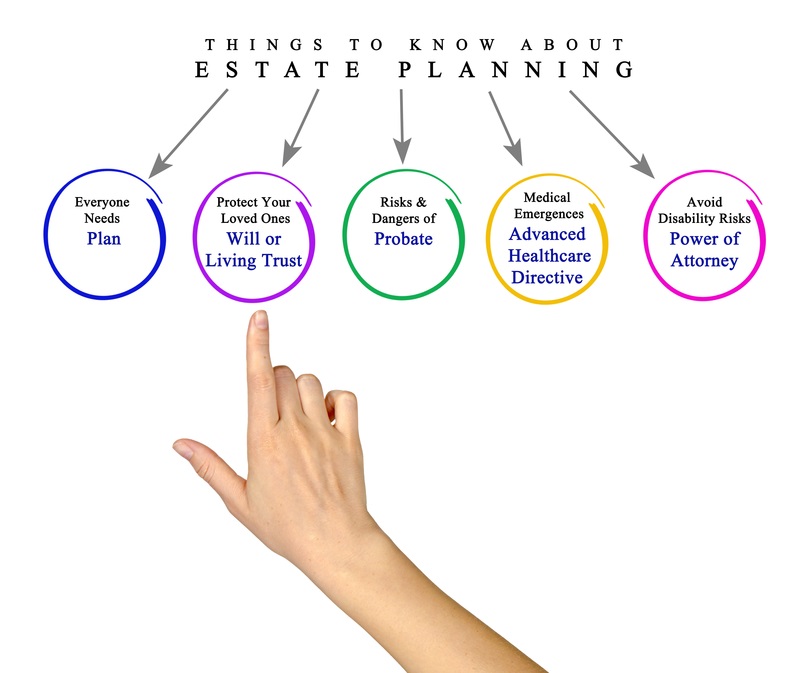

They help you produce a detailed estate plan that lines up with your desires and goals. Estate intending lawyers can help you avoid mistakes that might revoke your estate plan or lead to unexpected effects.

How Estate Planning Attorney can Save You Time, Stress, and Money.

Probate is a lawful process that occurs after someone dies, where the court chooses how their properties are dispersed. Working with an estate preparation attorney can help you avoid probate completely, saving time, and cash. An estate planning lawyer can assist safeguard your properties from legal actions, lenders, and other cases. They'll develop a plan that guards your possessions from prospective risks and makes certain that they go to your intended beneficiaries.

Cloud, Minnesota, connect to today. To find out more concerning bankruptcy,. To find out about genuine estate,. To find out about wills and estate planning,. To contact us, or call us at.

The age of bulk in a provided state is established by state laws; normally, the age is 18 or 21. Some possessions can be dispersed by the establishment, such as a bank or brokerage company, that holds them, as long as the proprietor has given the proper instructions to the banks and has actually named the beneficiaries that will certainly obtain those properties.

Unknown Facts About Estate Planning Attorney

If a recipient is called in a transfer on fatality (TOD) account at a brokerage company, or payable on death (VESSEL) account at a bank or credit scores union, the account can usually pass directly to the beneficiary without going through probate, and hence bypass a will. In some states, a similar beneficiary classification can be added to realty, allowing that asset to additionally bypass the probate process.When it involves estate preparation, a skilled estate lawyer can be an indispensable asset. Estate Planning Attorney. Working with an estate planning attorney can give numerous benefits that are not available when attempting to complete the process alone. From giving competence in lawful matters to aiding produce a detailed prepare for your family's future, there are many advantages of collaborating with an estate preparation attorney

Estate attorneys have substantial experience in recognizing the nuances of various legal records such as wills, trust funds, and tax obligation laws which allow them to provide sound recommendations on just how finest to secure your assets and ensure they are given according to your wishes. An estate attorney will also have the ability to provide guidance on exactly how finest to browse intricate estate laws in order to ensure that your wishes are honored and your estate is handled appropriately.

What Does Estate Planning Attorney Mean?

They can often offer advice on just how ideal to upgrade or produce new records when required. This may include suggesting adjustments in order to benefit from new tax advantages, or just making sure that all appropriate documents mirror one of the most present beneficiaries. These lawyers can also Get More Info provide recurring updates connected to the management of trust funds and various other estate-related matters.The objective is always to ensure that all documents stays legally precise and reflects your current dreams properly. A major advantage of working with an estate preparation attorney is the important guidance they offer when it comes to preventing probate. Probate is the legal process throughout which a court identifies the validity of a dead person's will and looks after the distribution of their assets in accordance with the regards to that will.

A skilled estate lawyer can help to make sure that all necessary papers are in place which any kind of assets are effectively distributed according to the terms of a will, preventing probate completely. Inevitably, dealing with a knowledgeable estate planning attorney is just one of the very best ways to ensure your desires for your family's future are executed as necessary.

They provide important lawful advice to ensure that the best passions view it now of any minor official source children or adults with impairments are fully shielded (Estate Planning Attorney). In such instances, an estate lawyer will certainly help determine ideal guardians or conservators and make certain that they are given the authority necessary to manage the assets and affairs of their fees

Estate Planning Attorney Fundamentals Explained

Such trust funds usually have provisions which shield advantages received through federal government programs while enabling trustees to preserve limited control over how properties are handled in order to make best use of advantages for those included. Estate lawyers comprehend exactly how these counts on job and can supply important assistance establishing them up appropriately and guaranteeing that they continue to be legitimately compliant with time.An estate planning lawyer can aid a parent consist of stipulations in their will certainly for the care and administration of their minor kids's possessions. Lauren Dowley is a skilled estate preparation legal representative who can help you produce a strategy that meets your details requirements. She will certainly collaborate with you to understand your assets and exactly how you desire them to be dispersed.

Do not wait to begin estate preparation! It's one of the most essential points you can do for yourself and your liked ones.

Not known Details About Estate Planning Attorney

Producing or updating existing estate planning records, consisting of wills, trusts, health treatment directives, powers of attorney, and related tools, is one of one of the most important things you can do to ensure your desires will be honored when you die, or if you become not able to manage your events. In today's electronic age, there is no scarcity of do-it-yourself options for estate planning.Doing so could result in your estate strategy not doing what you want it to do. Wills, trusts, and various other estate planning documents need to not be something you prepare when and never ever take another look at.

Probate and trust fund legislations are state-specific, and they do transform from time-to-time. Functioning with an attorney can give you tranquility of mind knowing that your strategy fits within the parameters of state legislation. One of the greatest mistakes of taking a do-it-yourself strategy to estate planning is the threat that your papers won't truly complete your goals.

Some Known Factual Statements About Estate Planning Attorney

They will consider various circumstances with you to compose documents that accurately reflect your wishes. One common misunderstanding is that your will or count on automatically covers all of your assets. The reality is that certain types of building possession and beneficiary designations on possessions, such as pension and life insurance coverage, pass separately of your will or trust unless you take steps to make them collaborate.Report this wiki page